Met HannaH wordt bedrijfswaardering eenvoudig en professioneel:

- importeer uw financiële gegevens vanuit uw boekhoudsoftware,

- stel met een paar muisklikken uw prognoses op,

- configureer de waarderingsmethoden,

- genereer automatisch een duidelijk, gestructureerd rapport dat klaar is om te worden gedeeld.

Discover the four methods HannaH offers in her Appreciation module below.

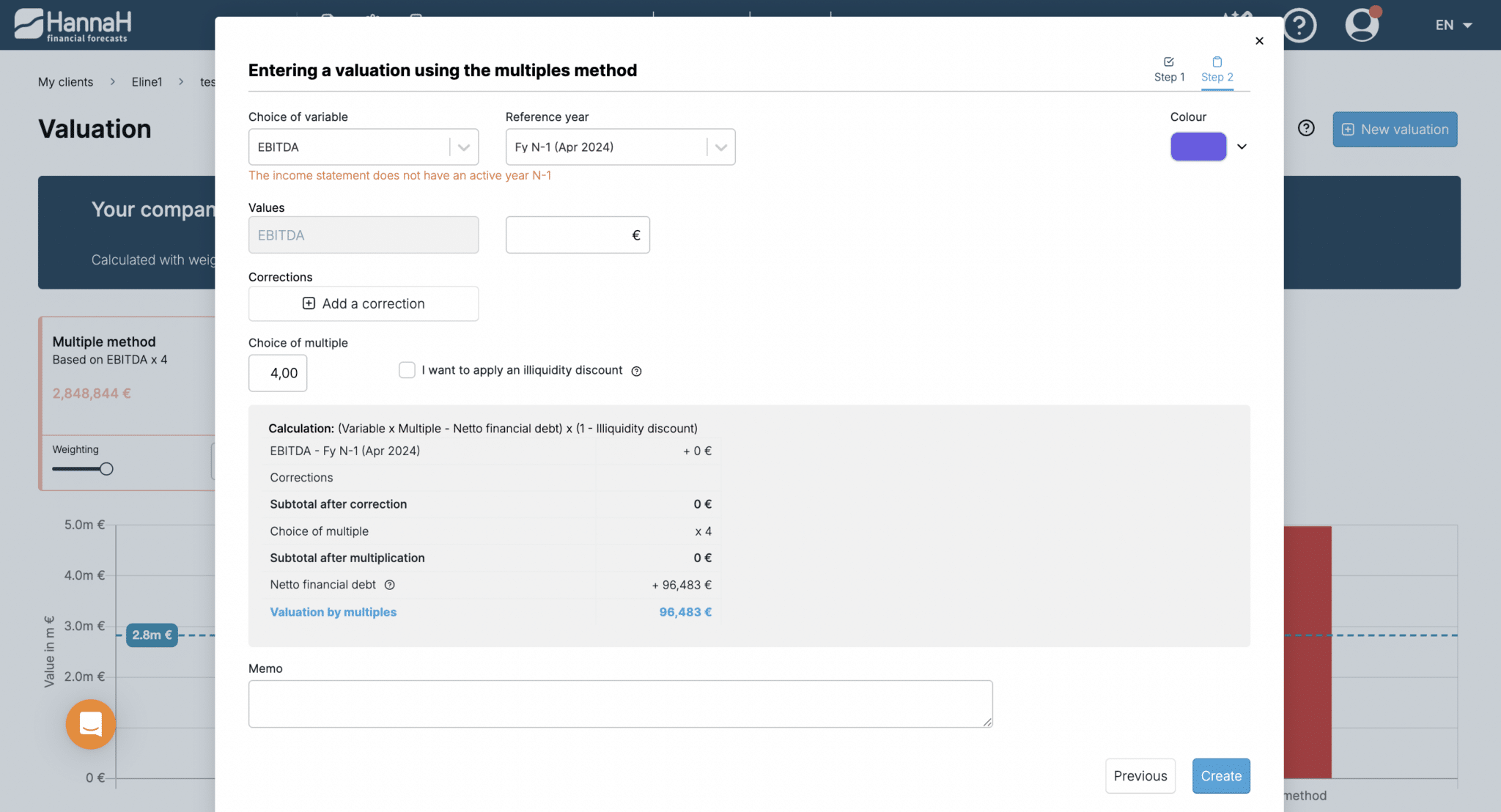

Multiple methode

The multiple method allows the value of a company to be estimated by applying a valuation factor to a key financial indicator of your choice.

The multiple depends mainly on the sector, market practices, and the company’s profile.

The financial indicators used may include EBITDA, turnover, or total assets.

This approach can be refined by taking into account net financial debt and, if applicable, applying an illiquidity discount to obtain a more realistic valuation.

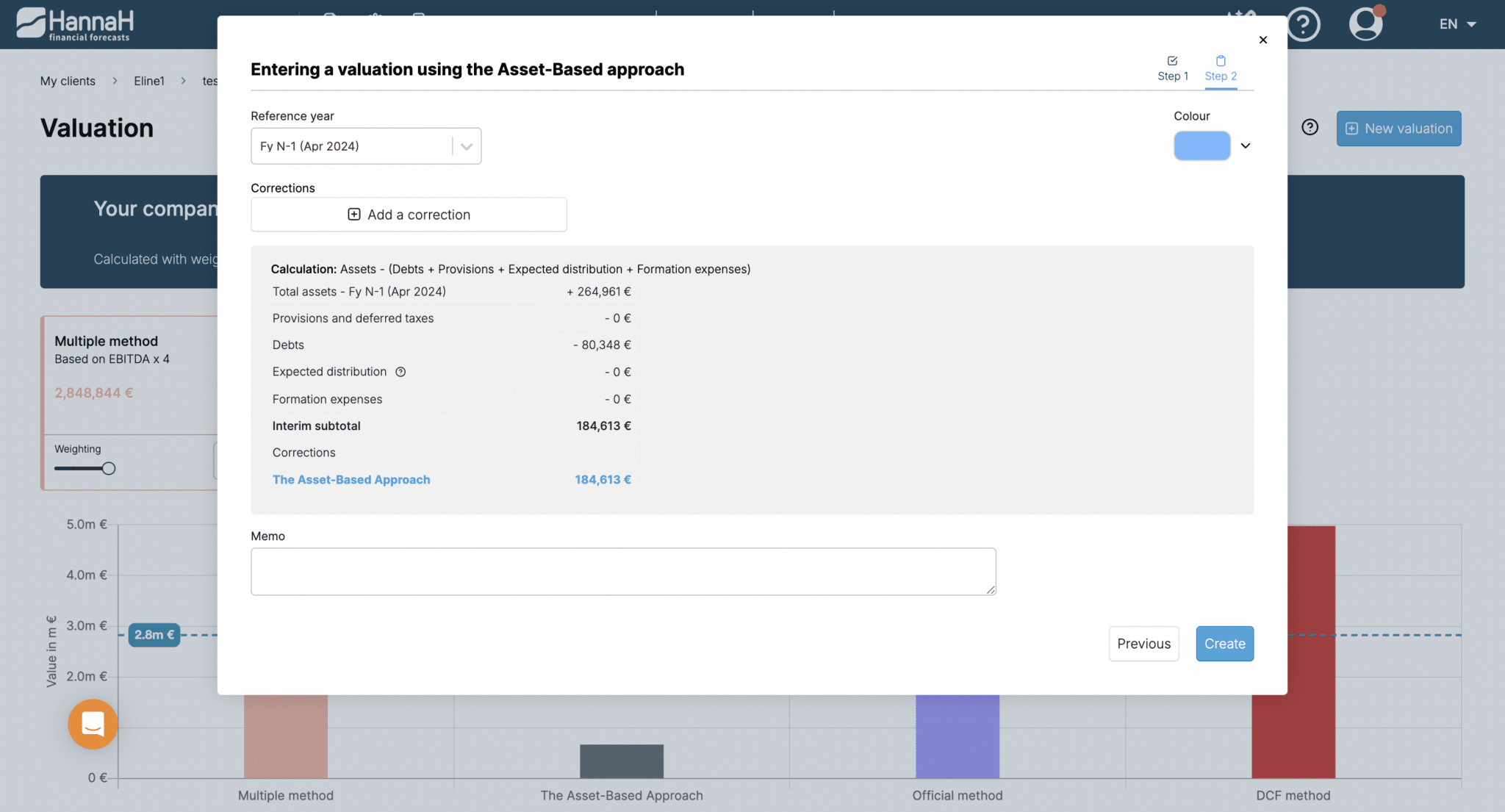

Intrinsic method

The adjusted net asset method is based on the revaluation of assets, less the company’s liabilities, to determine its true equity value.

This method is particularly relevant for companies with significant assets and is a conservative approach that provides a solid basis for valuation analysis.

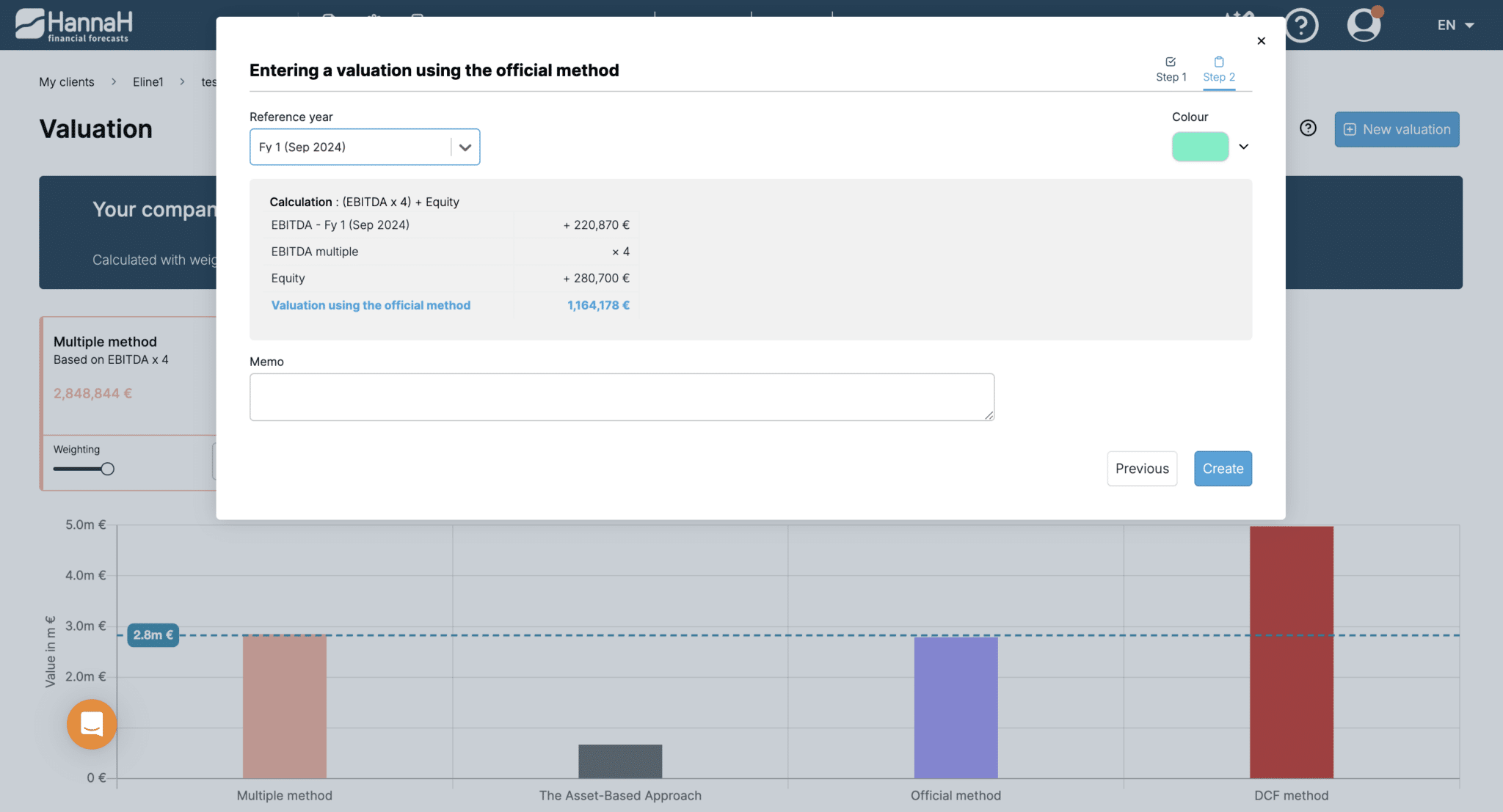

Official method

This method corresponds to the valuation approach used in the context of capital gains taxation.

It is based on a valuation equal to four times EBITDA, to which equity is added.

It is a recognized benchmark in a fiscal and regulatory context.

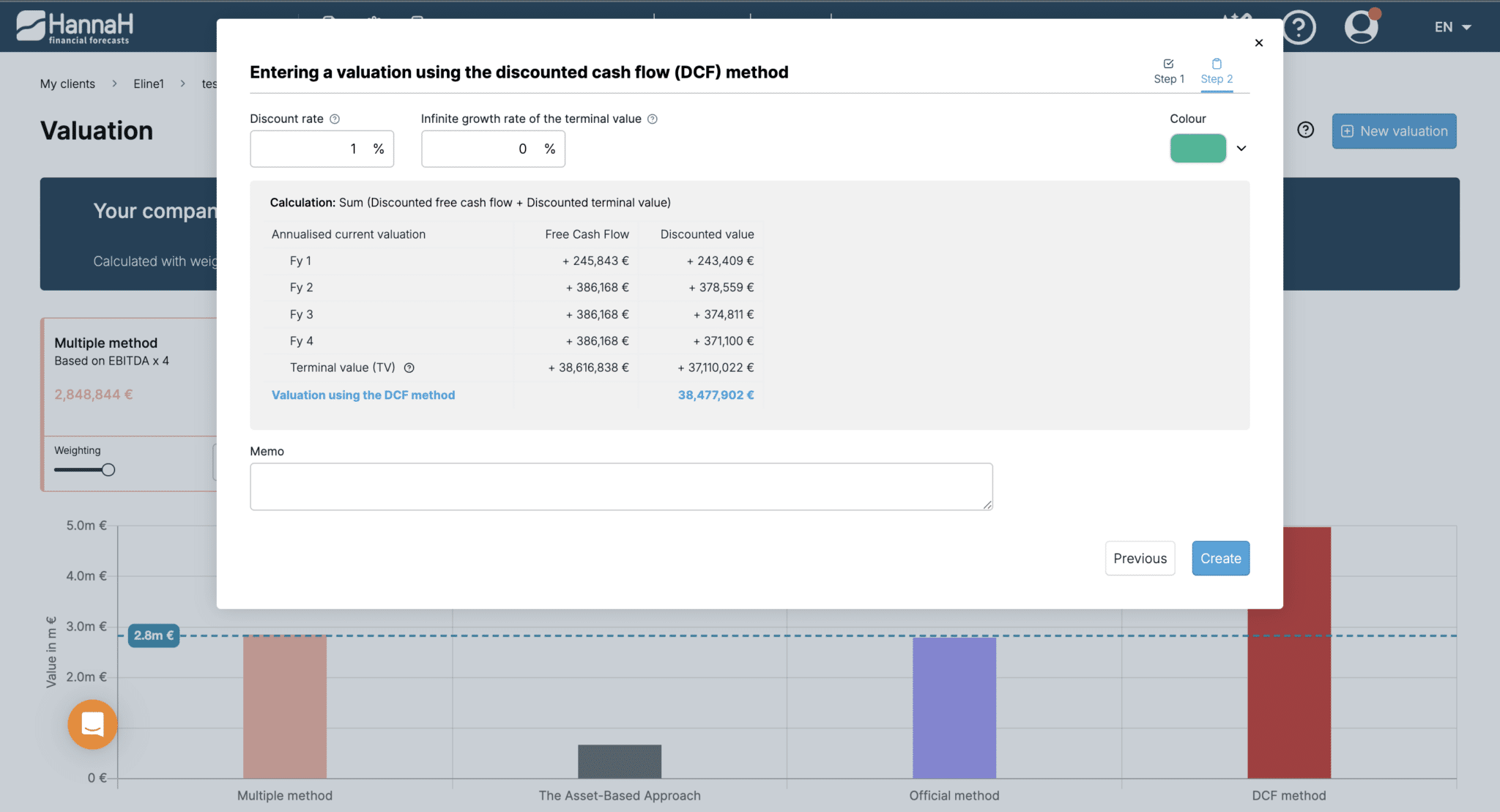

Discounted cash flow-methode (DCF)

The discounted cash flow (DCF) method values the company based on its ability to generate future free cash flows.

By discounting these flows, their value can be expressed in current terms and the company’s potential to create value can be highlighted.

This method is particularly suitable for companies with good financial visibility and identifiable growth prospects.

Rate - €500 excl. VAT per year *

Make informed decisions based on a solid and recognized valuation.

*Requirement: a HannaH subscription is required to access the valuation module.